|

SAMPLE SCENARIO FOR PLAN BCLICK HERE TO VIEW FREQUENTLY ASKED QUESTIONS ( FAQ ) |

MEDICAL BENEFIT

AIA Med-Assist covers your in-patient hospitalization and medical expenses through MediCard that comes with the plan. Because of its convenient co-pay arrangement, 90% of the bill will automatically be charged to AIA Philippines so that you will only have to pay the remaining 10%.

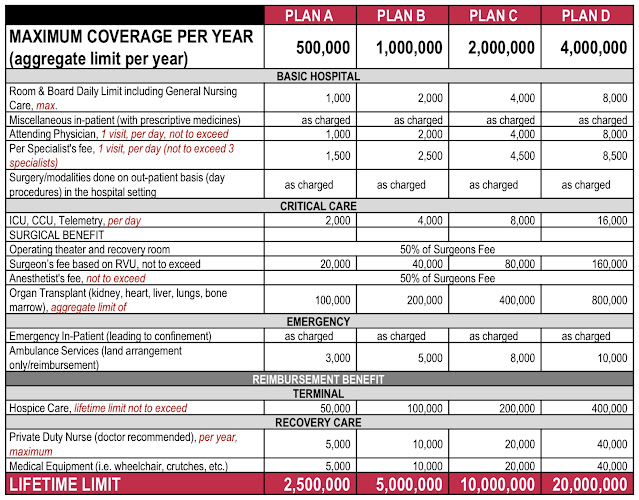

AIA Med-Assist can shoulder up to P4,000,000 annually depending on the type of Plan you choose.

|

| 4 DIFFERENT PLAN FOR MEDICAL BENEFIT RIDER |

DAILY HOSPITALIZATION INCOME

Get up to P3,000 worth of Daily Hospitalization Income for every day that you're confined, over the course of a year, to offset any income loss you may experience from being hospitalized. Avoid the stress of medical expenses and focus on recovery instead of having to worry about your daily income!

MEDICAL FUND

On top of providing financial solutions to health-related concerns, AIA Med-Assist also has an investment fund that can help you build your own medical fund in the future. So not only will you be covered for medical emergencies in the future, but you can also grow a considerable sum of medical savings after a designated duration

LIFE INSURANCE COVERAGE

In the event of loss of life, AIA Med-Assist will pay out a lumpsum cash benefit to your beneficiaries, which can go as high as 90 times your basic annual premium. This will help ease the financial burden that your loved ones may experience

WAIVER OF PREMIUM

In the event of total and permanent disability, you won't have to pay your basic annual premiums and special top-up payments anymore. This waiver frees you from financial worries so you can focus on more important things

AIA VITALITY

The best response to hospitalization is avoiding it altogether. By living better, you avoid sickness and other medical conditions that require confinement. AIA Med-Assist comes with AIA Vitality —a science-backed platform that encourages a healthier lifestyle by rewarding you for every step through your fitness journey. It empowers you to know your health, improve your health, and enjoy the rewards, keeping you strong and helping you live a healthier, longer, and better life.

CLICK HERE TO LEARN HOW AIA VITALITY WORKS

- Life Insurance

- Medical Benefit ( Inpatient care only covered by MediCard

- Daily Hospital Income

- Waiver of premium